Wedding Budgeting Calculator

Do you have a Question? Click here to ask us.

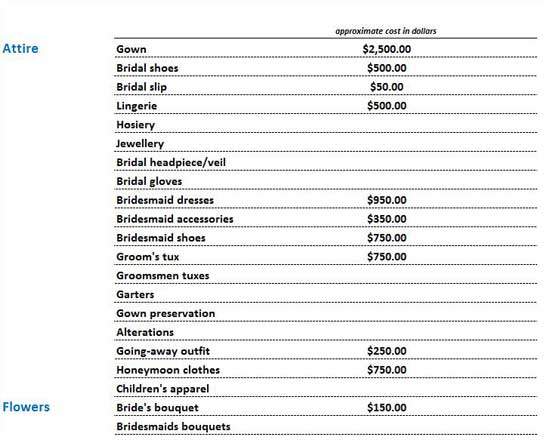

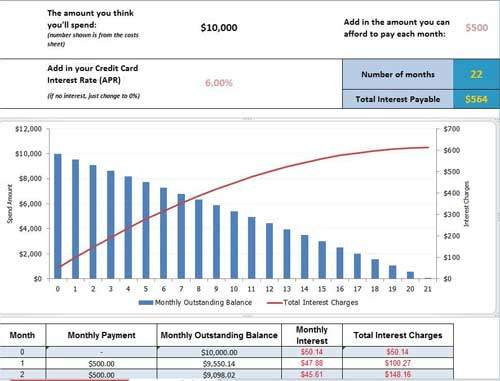

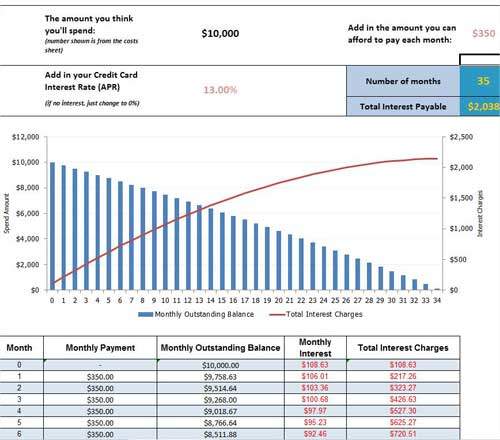

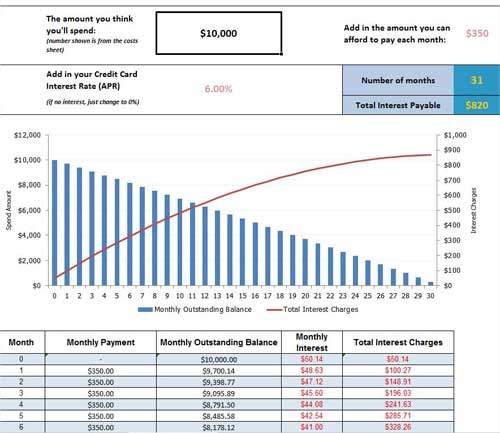

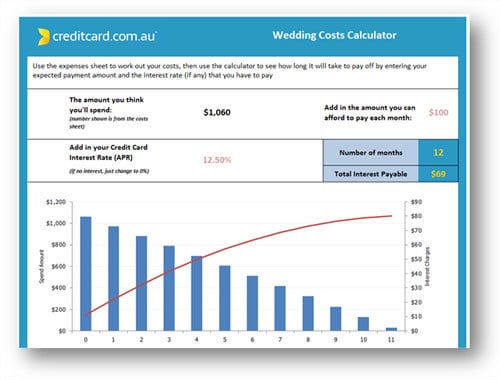

Who is this calculator for?This calculator is for anybody who is planning or paying for an upcoming wedding. You could be the bride or groom, or a parent who is funding the whole shebang. If your job is to work out the budget for your own or someone else’s upcoming wedding then you’ll definitely want to take a look at the creditcard.com.au wedding costs calculator. Don’t leave it too late either, as the longer you leave it before planning and paying off your wedding, the harder it will be. Apologies! Our travel budgeting calculator is currently offline for maintenance. What it does1. The wedding costs calculator tells you what you’re spending on each different aspect of your weddingYou can allocate how much you want to spend on each big expense (venue and catering, dress, honeymoon) and all of the little extras. When you know how much needs to go towards the bigger essentials, you can see how much you might have available for the things you want to make the day extra special. Understand the different expenses Work out what type of wedding you can really have 2. Gives you a timeframe for paying off any expenses put on creditIf you need to borrow any money on your credit card or take out a loan the calculator gives you an idea how long it will take to pay off, and any interest charges that come with the debt. You’ll know exactly how many months or years it will take to be debt free. If you use different credit cards you can add and adjust the interest rates that apply to the different debts. How to Use itSheet 1: Expenses ListThe expenses sheet will show the total cost of your planned spending on the different wedding expenses you have. Once you’ve added everything in and see the total, you can adjust spending in different areas to make sure you don’t go over your original budget.

|

Share

|

Useful LinksCiti ready credit card fixed repayments |