Travel Budgeting Calculator

Do you have a Question? Click here to ask us.

Who is it for?Anyone – travelling anywhere! Are you planning some sort of trip or journey? Moving your life to somewhere new? This guide is for anyone taking a trip – whether it’s overnight out of town or a year-long holiday on around the world. Apologies! Our travel budgeting calculator is currently offline for maintenance. What it does1. Work out total likely costs for your tripThe travel costs sheet means you can add in all likely costs to see exactly how much it will all cost – and then decide if you can afford it all. Go back and change things if you need to fit your budget. The list contains ideas to remind you of what you will likely need to pay for, and also gives plenty of free space to add in other personal costs you might want to consider. 2. Shows how long it will take to pay off any borrowings or creditIf you need to borrow any money the calculator will help show how long it will take to pay off, and also any interest charges you might have. If you need to use credit you can see likely interest charges. If you’re borrowing money with no interest you can work out how long it will take to pay it back. How to Use itSheet 1: Expenses ListThe expenses sheet will calculate the total cost of your planned expenses. When you finish and see the total amount you can go back and adjust the list if necessary.

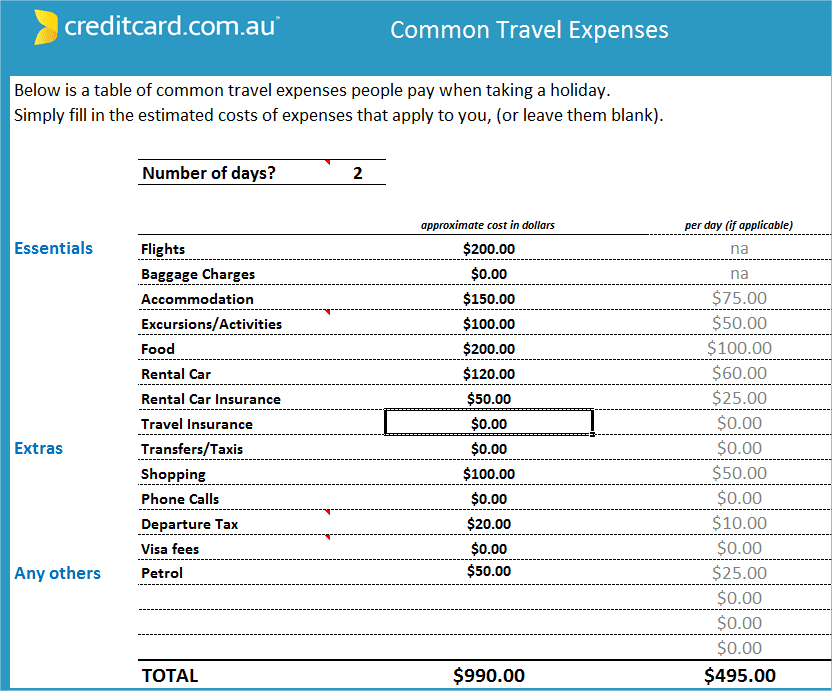

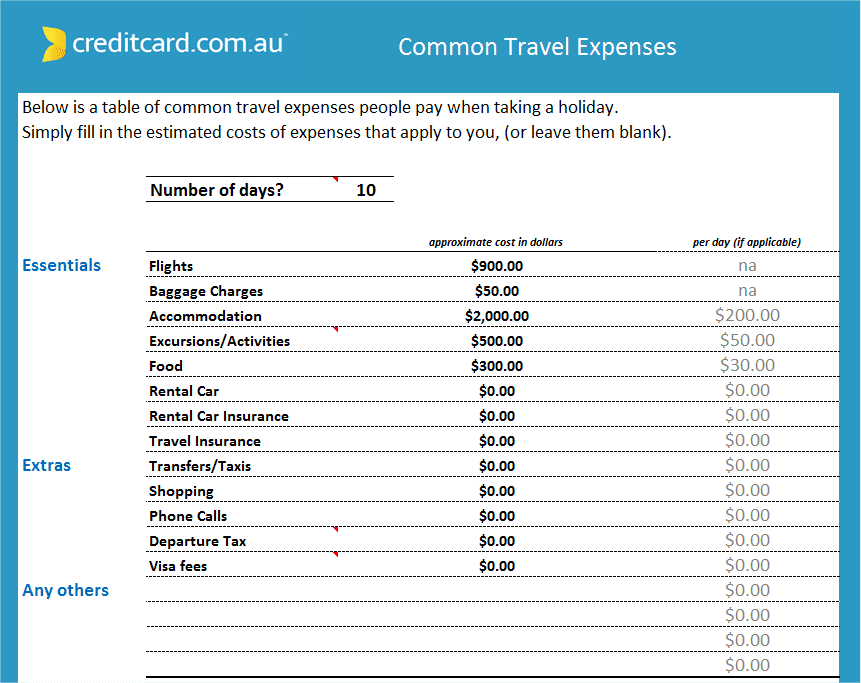

List all your travel expenses, be sure to add new rows or delete ones you don’t need!

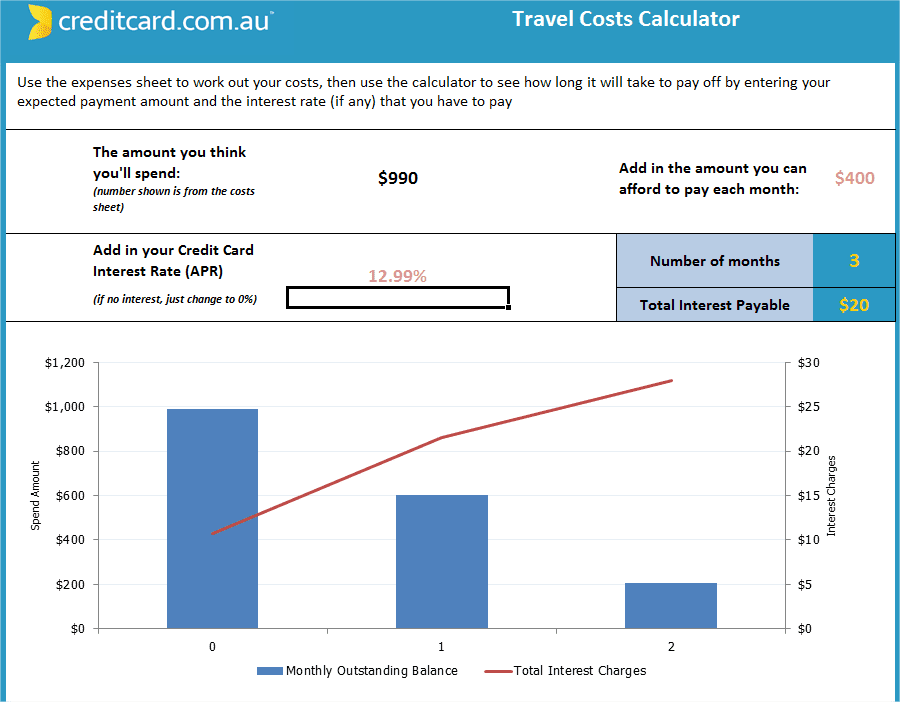

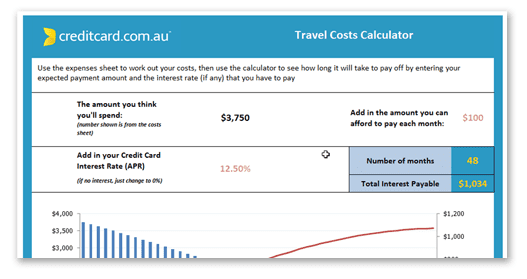

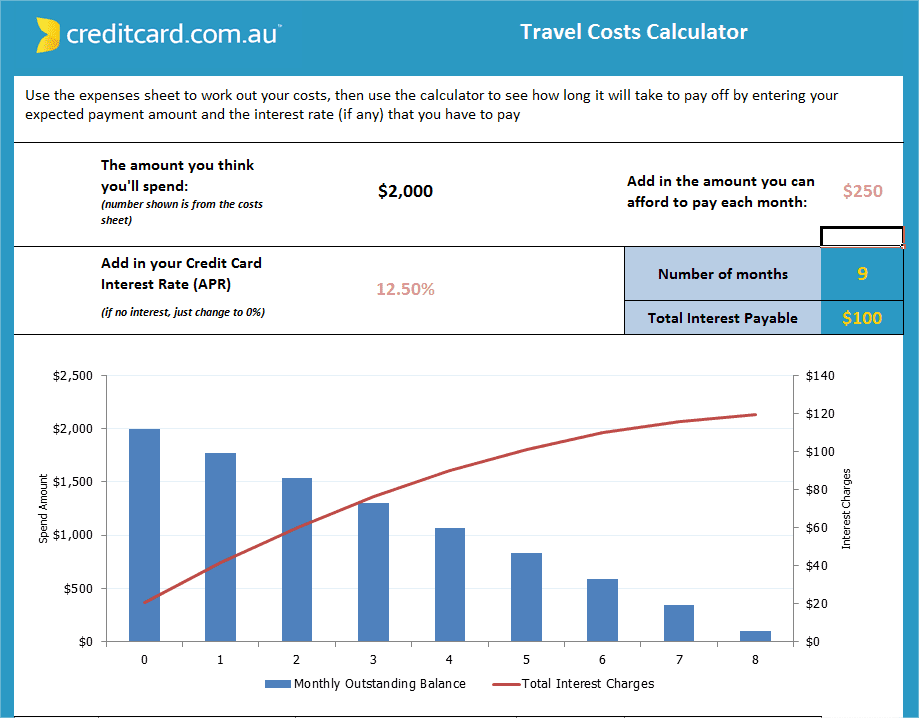

Sheet 2: Travel Costs CalculatorThe calculator will calculate how long it will take to pay off the total spend and how much interest will be charged (if applicable).

The calculator will show the number of months it will take to pay the cost off + the number of months it will take to do so Examples of use – Planning a weekend awayJack and Jenny planned a weekend trip to Melbourne to stay in the city, and drive out one day to visit wineries out of town. They wanted to spend no more than $1,000 in total, but also eat and drink well, and stay in a good hotel.

They used the calculator to work out they could pay off the total cost of $990 over 3 months, paying $400 each month and paying $20 in interest charges.

Help SectionEssential Costs – you will need to be able to get to your destination, you will need food and shelter when you get there! If you’re driving there consider the cost of petrol. If you’re staying at a friend’s place you might like to give them a present to say thank you – put that in there! If you need help on projected costs for flights – do an online search for flight prices around that time and use that figure. The same applies to hotel costs. If you have no idea how much to budget for things like food, taxi’s in a foreign country try checking out the Lonely Planet website or a similar travel site. These sites usually have practical information for each country which will suggest typical costs of local food, taxis, sight-seeing – even sometimes foreign exchange rates. Non-Essential Costs – try to think of everything you might need or want to buy while you’re away. For example the cost of petrol in a hire car, the costs of roaming on an international tariff on your mobile phone – all costs you could reduce or maybe even go without if you need to cut down your total costs. There may be costs that you don’t think of until you’re away – the attractiveness of a once in a life time experience will be higher when you’re there, and wondering if you’ll ever get a chance to do it again! (Think hot air ballooning, visiting a wonder of the world, seeing a rare performance). |

Share

|

Credit Card Travel TipsCredit cards with no international fees |